How AI is Transforming Financial Services

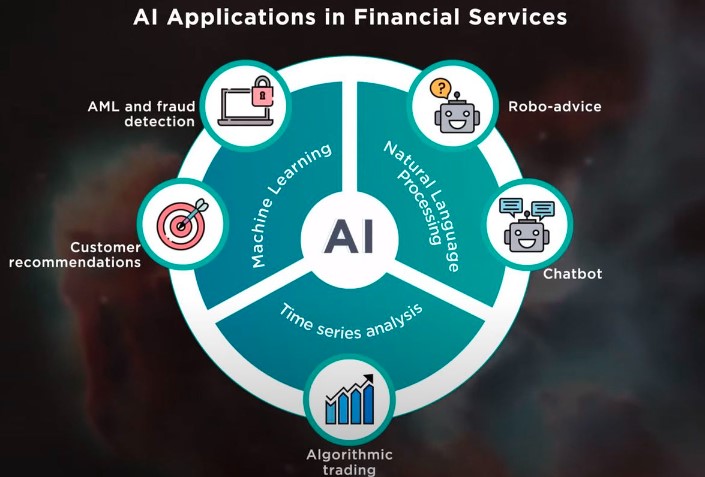

Artificial Intelligence (AI) is revolutionizing industries worldwide, and the financial sector is no exception. From enhancing customer experiences to strengthening fraud detection, AI is fundamentally reshaping how financial institutions operate, serve clients, and manage risks. As more organizations adopt AI, it’s becoming clear that this technology is not just a trend—it’s the future of finance.

1. Enhancing Customer Experiences

In today’s fast-paced world, customers expect personalized, seamless experiences, and AI makes this possible. AI-driven chatbots and virtual assistants provide 24/7 support, instantly addressing common inquiries and guiding users through complex transactions. Natural language processing (NLP) enables these systems to understand customer queries, offering human-like responses and making banking easier and more accessible.

AI also allows financial institutions to offer personalized recommendations. By analyzing transaction history and financial behavior, AI can suggest relevant products like loans, savings accounts, or investment opportunities, tailored to each customer’s unique needs. This level of personalization increases customer satisfaction and drives customer loyalty.

2. Strengthening Fraud Detection and Security

One of the greatest challenges in financial services is fraud detection and prevention. Traditional methods can often miss sophisticated cyber threats or generate false positives, frustrating genuine customers. AI’s ability to analyze vast amounts of data in real-time is transforming how institutions handle fraud.

Machine learning algorithms can detect unusual patterns, such as atypical spending behavior or irregular login locations, which may indicate fraud. Unlike static rules-based systems, AI can learn from past data, continuously improving its ability to spot suspicious activities. This proactive approach reduces fraud and enhances security, making financial services safer for everyone.

3. Improving Credit Scoring and Loan Underwriting

AI is also changing the landscape of credit scoring and loan underwriting. Traditional credit scores rely on historical data, but they don’t always provide a full picture of an individual’s financial health. AI-driven models, however, analyze a broader range of data points, including social behavior, spending habits, and even employment history, to create a more comprehensive risk assessment.

This approach allows lenders to evaluate applicants who may not have a strong credit history but demonstrate responsible financial behavior. As a result, AI enables more inclusive lending, helping previously underserved individuals and small businesses access the financing they need.

4. Streamlining Compliance and Regulatory Processes

Financial institutions are highly regulated, and compliance is often time-consuming and costly. AI streamlines this process by automating routine compliance tasks, such as monitoring transactions for compliance with anti-money laundering (AML) regulations.

Through AI-driven data analysis, institutions can quickly identify suspicious activities that require further investigation, reducing the time and resources needed to maintain compliance. Additionally, AI systems can help create audit trails and generate reports, ensuring financial institutions are always prepared for regulatory reviews.

5. Advancing Investment and Wealth Management

AI is becoming a valuable tool in investment and wealth management. Robo-advisors, powered by AI, are making financial planning more accessible and affordable. These advisors use algorithms to assess risk tolerance, investment goals, and market conditions, allowing them to create personalized investment strategies for clients.

Moreover, AI-driven predictive analytics enables wealth managers to make more informed investment decisions. By analyzing market trends, economic indicators, and even social sentiment, AI can help predict market movements and identify investment opportunities, optimizing portfolio management for better returns.

6. Optimizing Risk Management

Risk management is essential in finance, and AI significantly enhances this process. Predictive analytics allows institutions to foresee potential risks by analyzing historical data and identifying patterns that may indicate future issues. AI models can consider factors such as market volatility, economic conditions, and geopolitical events to create a comprehensive risk profile.

By automating risk assessment, AI enables faster, more accurate decision-making, helping institutions mitigate risks more effectively. This real-time risk management capability is particularly beneficial in high-stakes areas like trading and investment banking.

7. Increasing Operational Efficiency

AI doesn’t just enhance customer-facing services—it also improves internal processes, boosting operational efficiency across the board. For example, AI-powered automation can handle repetitive tasks such as data entry, report generation, and document verification, freeing up employees to focus on more strategic work.

In addition, AI can streamline back-office processes like claims processing and customer onboarding. By reducing manual labor, financial institutions can lower operational costs, improve accuracy, and accelerate service delivery.

Challenges of AI in Financial Services

While AI offers many benefits, integrating this technology into financial services isn’t without challenges. Concerns about data privacy and security, regulatory compliance, and the ethical use of AI are significant. Financial institutions must navigate these issues carefully, ensuring AI solutions are transparent, fair, and aligned with regulatory requirements.

Additionally, the implementation of AI requires a skilled workforce capable of managing and maintaining these complex systems. Training employees to work alongside AI is crucial for the successful adoption of this technology.

Conclusion

AI is a powerful tool that is transforming the financial sector, making services faster, more personalized, and more secure. From enhancing customer experiences to improving fraud detection, AI is helping financial institutions stay competitive in a rapidly changing landscape. As the technology evolves, its impact on financial services will continue to grow, creating new opportunities for innovation and efficiency.

Embracing AI is no longer optional for financial institutions that wish to thrive in the digital age. By harnessing the power of AI responsibly and strategically, financial organizations can provide greater value to their customers, mitigate risks, and drive business growth.