The role of Fintech and Infrastructure Investments in Transforming Financial Inclusion in Emerging Markets

- Globally, 1.4 billion people lack access to essential financial services, revealing a significant gap in financial inclusion, particularly in developing economies.

- Financial technology (fintech) is emerging as a game-changer, offering digital solutions like mobile money transfers and microloans that can reduce poverty and foster economic growth.

- Micro, small, and medium enterprises (MSMEs) are vital to the global economy, yet they often struggle with limited financial access. Fintech and infrastructure improvements are key to unlocking their potential.

- Transformative fintech solutions like blockchain and AI are paving the way for more inclusive financial systems.

- Establishing trust through localized approaches and transparent practices is critical for the success of digital financial inclusion efforts.

Fintech Can Boost Financial Inclusion

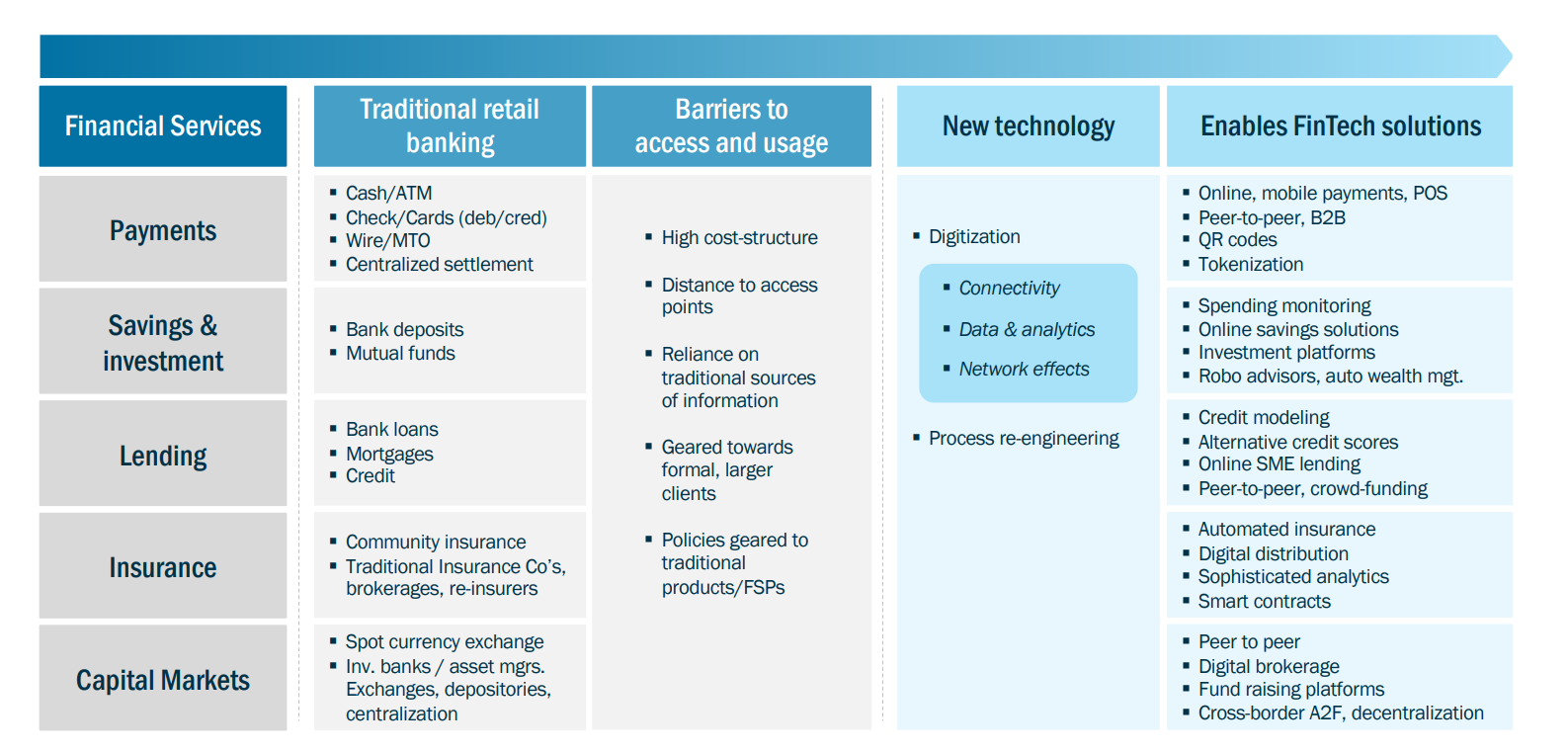

Financial technology (fintech) is emerging as a powerful tool to bridge the financial divide. By providing affordable and accessible digital services like mobile money transfers and microloans, FinTech has the potential to reduce poverty and foster economic growth significantly. The transformative power of fintech lies in its ability to deliver essential financial services to unbanked and underserved populations, breaking down traditional barriers to financial inclusion.

Empowering Local Economies with Digital Currencies

In addition to traditional fintech solutions, digital currencies like Bitcoin are increasingly being used by local communities to conduct transactions and purchase goods. This trend represents a significant shift in how financial interactions are conducted at the grassroots level. Bitcoin and other cryptocurrencies offer a decentralized method of payment that can be particularly beneficial in areas with limited access to traditional banking infrastructure.

For example, in regions where banking services are scarce or unreliable, digital currencies provide an alternative means for individuals to engage in commerce, manage their savings, and even invest. This adoption of digital currencies is not only expanding financial access but also promoting economic activities by enabling local transactions and reducing transaction costs associated with traditional banking systems.

Moreover, the use of cryptocurrencies can enhance financial inclusion by offering a platform for cross-border transactions, allowing individuals and businesses to engage in the global economy with greater ease. As fintech continues to evolve, the integration of digital currencies into local economies highlights the growing importance of innovative financial solutions in achieving broader financial inclusion.

Revolutionizing Financial Services with Blockchain and AI

Fintech’s role in financial inclusion extends beyond mere access to digital financial services; it fundamentally reshapes how financial interactions occur for the underserved. Blockchain technology, for example, offers a decentralized approach to financial transactions that can be more secure and less costly than traditional banking systems. This technology enables users to perform transactions without intermediaries, reducing fees and making financial services more affordable.

Moreover, fintech platforms often provide financial education and tools to help users manage their finances effectively. Apps that offer budgeting advice, savings plans, and investment opportunities democratize financial knowledge, empowering users to make informed decisions. This education is crucial for those who have been traditionally excluded from the financial system, as it helps them build credit histories, access loans, and plan for the future.

The integration of artificial intelligence (AI) and machine learning in fintech further enhances this potential. AI can analyze vast amounts of data to tailor financial products to individual needs, predict creditworthiness, and detect fraud more effectively. These advancements ensure that fintech solutions are not only accessible but also responsive and secure, addressing the specific needs of diverse populations.

Infrastructure Investment: A Catalyst for Economic Development

Investment in network infrastructure is crucial to overcoming the digital divide. Companies like e& are leading the way by pledging substantial investments to enhance network connectivity across various regions. For instance, e& has committed $6 billion to improve network infrastructure and digital services in 16 countries across the Middle East, Africa, and Asia between 2024 and 2026.

These investments aim to accelerate technology adoption in both developed and emerging economies. In Pakistan, e& has already made significant strides by expanding fiber broadband to over one million homes and enhancing 4G mobile network coverage. These efforts are critical in providing affordable and reliable connectivity, enabling individuals in remote or underserved areas to access essential digital services.

Transforming Local Economies Through Connectivity

Infrastructure investment plays a pivotal role in enabling economic development by laying the foundation for digital inclusion and economic activities. High-speed internet and reliable network connectivity are critical for businesses to operate efficiently, access global markets, and compete effectively. For emerging economies, improving network infrastructure means that entrepreneurs and businesses can leverage online platforms to reach new customers, access financial services, and participate in the global economy.

In rural and underserved areas, where traditional banking infrastructure is limited, expanding digital infrastructure can dramatically change the economic landscape. It opens up new opportunities for education, healthcare, and business development, fostering a more balanced economic growth across regions. For example, enhanced connectivity allows educational institutions to offer online courses and remote learning opportunities, which can be a game-changer for communities with limited access to quality education.

Furthermore, investment in infrastructure supports the development of smart cities, where integrated digital solutions enhance urban living, improve public services, and drive sustainable growth. By bridging the digital divide, infrastructure investments not only stimulate economic activity but also contribute to broader social and developmental goals.

Building Trust and Ensuring Sustainable Growth

Fintech solutions are offering greater accessibility and efficiency compared to traditional retail banking. Unlike conventional banks, fintech platforms provide digital-first services that enable transactions anytime, anywhere, and at lower costs. This innovation is crucial for underserved populations who may lack access to physical bank branches. Fintech solutions, such as mobile banking apps and digital wallets, simplify financial management with user-friendly interfaces and real-time transactions. They often incorporate advanced technologies like AI for personalized services and blockchain for secure transactions, making financial services more inclusive, transparent, and responsive to individual needs.

The ultimate goal of financial inclusion is to empower individuals and businesses, drive economic growth, and promote social equality. By leveraging telecom infrastructure and tailoring financial products to the needs of underserved communities, fintech can create a data-rich ecosystem that informs the development of future financial services. This convergence of convenience, empowerment, and economic growth is reshaping the landscape of financial inclusion, paving the way for a more equitable and prosperous future.